Dear millennial news reader, it is yet again a lovely Monday. I hope the weekend brought you good tidings and rest.

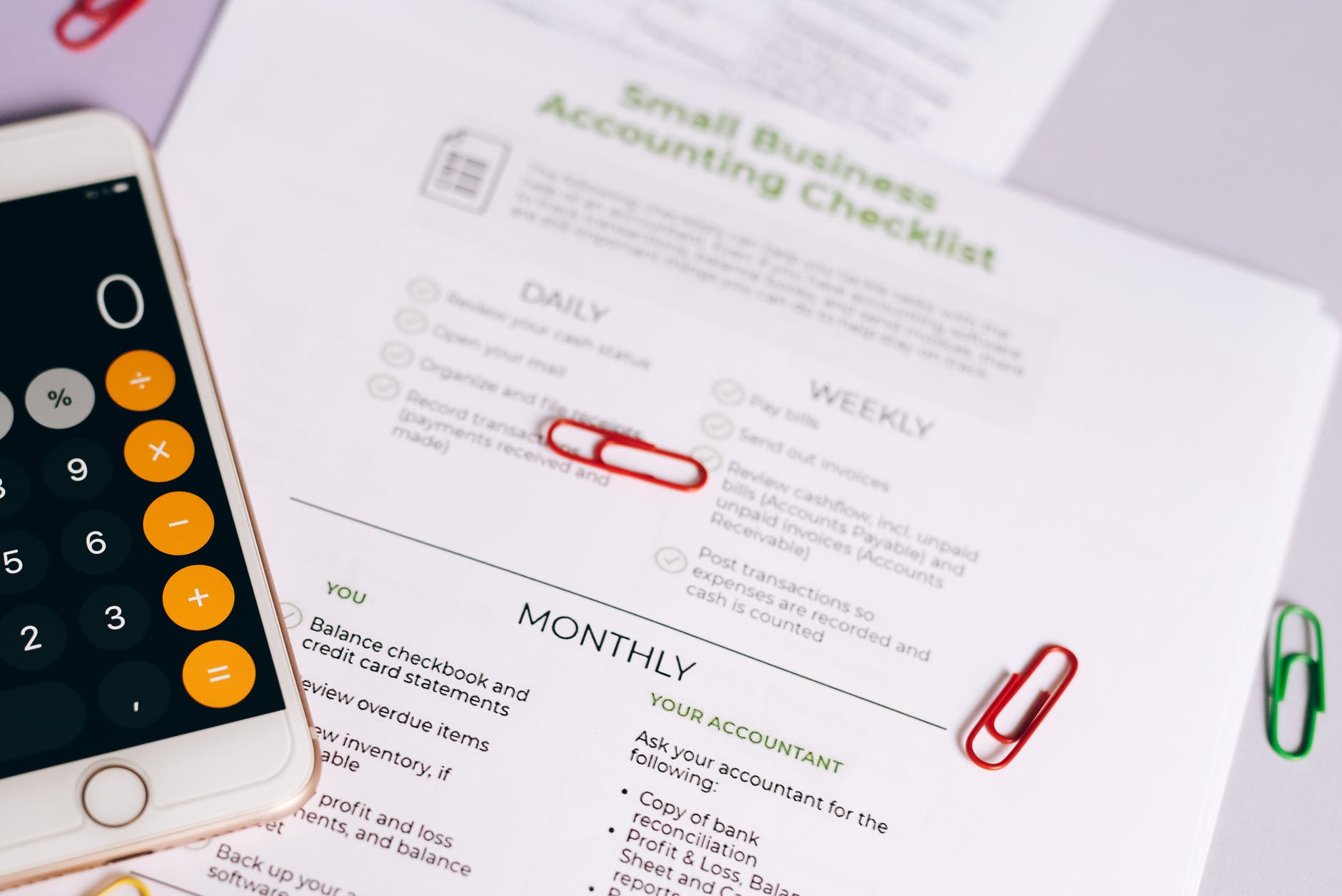

In the past two weeks, we have been talking about financial management: how millennials are managing their money and the subject of millennials and money. The issue of money or finances has been really on my mind. As a young person, it is easy and sometimes reckless to say that ‘you only live once’ and squander salaries or pocket money we get from our jobs and parents, respectively. There are books on financial management such as ‘Rich dad Poor dad’ and ‘The Richest Man In Babylon’. There is more content on financial management now than ever. Now there are also millennials and gen zs on YouTube, TikTok and Instagram talking about financial literacy. I would like to know how you are learning about financial management, please share in the comment section below.

Now, did you know that millennials and gen zs handle money differently? Or rather, these two generations view finances differently and even their approaches to the subject are different. To be on the same page, millennials are those who were born between 1981 to 1996 (ages 26-41) while gen zs is those who were born between 1997 to 2012 (ages 10-25). While these two generations are commonly highlighted as millennials, they differ in various ways. Today, let’s talk about how they differ in financial management.

- Budgeting

The oldest millennials are entering middle age, and despite their often-unearned rep as financially frivolous, they tend to be prudent budgeters. On the other hand, gen zs don’t love budgeting as much as millennials do. When it comes to using budgeting tools like personal finance apps, digital spreadsheets and moving money between savings accounts, millennials utilize all of these options more than gen zs.

- Debt management

Gen Zers have higher credit scores and are less likely to have difficulty paying off debt since they’re less likely to take it on. Millennials, on the other hand, are more likely to take action to mitigate their debt instead of just making payments. Millennials turn to refinance and consolidation options to manage their student loans more than Gen Z.

- Learning from older generations

Gen Zers are influenced and continue to be influenced by the misfortune of the millennials that came before them -the mountains of student loans, and the overspending on borrowed money. As far as Gen Z financial habits go, they’ve been shaped by those experiences and the experiences of their parents and older siblings, the millennials. They hate debt. They’re also more frugal and interested in managing their money.

- Banking and technology

Millennials grew up in an evolving technological world while gen zs grew up in a digital world. That doesn’t mean, however, that Gen Zers have a blind spot for traditional banking. While they overwhelmingly prefer online and mobile banking, they’re more likely to visit a bank branch weekly than any other generation.

There are many other ways in which these two generations differ in their approaches to life and finances. What other ways do you think they differ? Please share in the comment section.

Till the next time, bye and happy reading!

Ruthie Kimani ♡♡♡