Last week we looked at IDs and how we take loans using them. Millennials are known to be swift in acquiring soft loans without knowing the benefits and risks it comes with.

I bet if you have tried acquiring loans from a soft loans app there is always a limitation to the amount of money you can ask for and that’s known as your credit worth which is determined by a credit score.

A credit score portrays a consumer’s worthiness of credit. One with a higher score means they are ranked top to potential lenders. Your credit worth is determinable by only 3 digits, between 300 to 850.

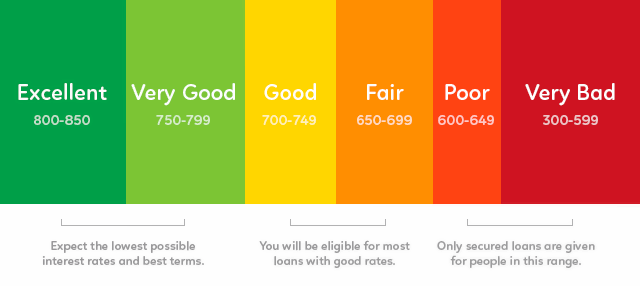

There are two major financial credit scoring models; FICO score and VantageScore. We will have a look at the FICO score, who reported that the average score is 706. Well worldwide credit scores can fluctuate because of influence by the economy. The average baseline can be useful to measure your own credit score. A FICO credit score scale is listed below:

- Poor credit score is between 300 – 579

- Fair credit score is between 580 – 669

- Good credit score is between 670 – 739

- Very good credit score is between 740 – 799

- Excellent credit score is between 800 – 850

A VantageScore scale varies from the FICO score scale, this is how it looks;

- Very Poor credit score is 300-499

- Poor credit score is 500-600ç

- Fair credit score is 601-660

- Good credit score is 661-780

- Excellent credit score is 781-850

The reason why knowing your credit score matters is because:

1. Having a low credit score may limit you from receiving credit and in some instances credit may be denied.

2. Even when getting credit we all expect favorable terms but a bad credit score may subject you to high interest rates making the debt more expensive. It’s limitations come in even being unable to purchase luxury products and services.

3. Knowledge of your credit score enables you to have a strong future goal plan.

How to improve credit score

The good thing is there are many ways to improve credit score. Paying your debt off within the stipulated time frame improves your credit score. A single delayed payment can make a borrower be termed unreliable and hence credit unworthy.

Limiting the number of loans taken at a time for example within a span of one week taking 4 loans from different institutions may seem like you are desperate for credit and may reduce your credit score worth. Try keeping your existing debts at a low as it shows less risk of credit worthiness to potential lenders hence increasing your credit score.

If you are in Kenya and want to check your credit score then Metropol can assist you with that information, simply dial *433#. Make the necessary payments and they will send you a PDF with information of all your loans including Fuliza, any outstanding arrears and with which institution. It links all the banking and loan institutions related to your ID number. See how simplified financial life can get.

MaryMwas ♥️♥️♥️